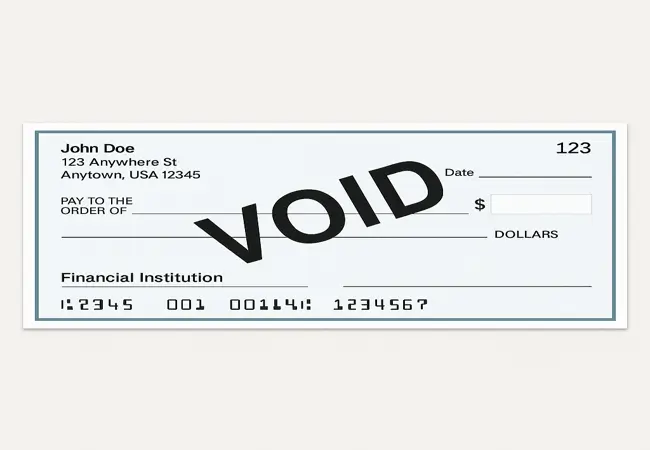

What Is a Void Cheque? A void cheque is a regular cheque you’ve deliberately disarmed by writing “VOID” across its face. Though it can’t be cashed or deposited, it still carries your bank’s routing number and your account number, making it the go‑to tool whenever you need someone, your employer, landlord, or service provider to pull funds or push payroll electronically without risking an open cheque.

What Makes a Cheque “Void” and Why It Matters

Have you ever misdated a check or left the payee line blank by mistake? Voiding that check stops anyone from filling in the blanks and cashing it fraudulently. Aside from error repair, void cheques have an important purpose, which is transmitting accurate banking information via the secure MICR line at the bottom, preventing the “oops, I typed a zero too many” instances that occur when keying in numbers manually.

Anecdote: Last year, my friend Lisa attempted to make a gym membership payment by reading her account number over the phone. One stray digit landed her monthly dues in a stranger’s account and she spent two weeks chasing down customer service instead of getting her workouts in. A void cheque would have saved her that headache.

Explore More: How to Fill Out a Cheque Deposit Slip

How to Use a Voided Cheque

- Direct Deposit for Payroll

Picture Monday morning: instead of handing in a paper cheque, you scan your voided cheque to HR. Their payroll system reads the MICR line and, come Friday, your salary hits your bank account like clockwork.

- Automatic Bill Payments

Want your rent, insurance premiums, or utility bills paid without logging in every month? Provide a void cheque to the billing company. They’ll debit the exact amount—no late fees, no missed due dates.

- Account Linking for Investments

Opening an online brokerage? They’ll ask for a void cheque to link your checking account for funding trades. That way, when you buy shares, the money transfers smoothly, and you’re not scrambling to input long number strings under pressure.

How Do You Write a Void Check

You cannot cash or deposit a voided check. However, there are circumstances in which you may need to void a cheque even if you are unable to make a payment with it.

1. Grab a Fresh Cheque

Start with a clean, unused cheque, not one that’s already filled out or has scribbles on it. Using a fresh cheque helps avoid confusion and makes it clear that this cheque is only for sharing your banking details, not for making a payment.

2. Mark “VOID” in Big, Bold Letters

Use a black pen or marker to clearly write the word “VOID” across the face of the cheque. Make the letters big enough to cover most of the space but be careful not to cover the numbers at the bottom. Writing it in this manner assures that the cheque cannot be utilized while displaying your account information.

3. Slash Through the Date and Amount Lines

Use a single line to cross out the empty spaces where you’d usually write the date, amount, or payee name. This is just an extra step to make sure no one tries to fill in the cheque and use it like a real one.

4. Double‑Check Visibility

Once you’re done, hold the cheque up to a light to make sure everything is still readable—especially the numbers along the bottom. These numbers are the most important part, so you want to be sure they’re not smudged or covered.

Explore More: How to Fill Out a Cheque Correctly in 6 Easy Steps

How to Read a Voided Cheque

On any cheque, you’ll find three sets of numbers in that funky magnetic‑ink font:

- Transit (Branch) Number: Identifies the specific branch which is usually five digits.

- Institution Number: Your bank’s three‑digit code.

- Account Number: The number assigned to your personal bank account, which is typically 7-12 digits.

When you hand over a void cheque, the recipient uses these exact numbers, no guesswork or no errors.

Getting a Void Cheque if You Don’t Have One

Banks know not everyone carries a chequebook these days. Most online banking portals let you download a “void cheque” or “direct deposit form.” Simply log in, locate the direct‑deposit section, download their PDF, and either annotate “VOID” digitally or print and mark it by hand. Your employer or vendor will treat it the same as a paper cheque.

Alternatives to Voided Cheques

If physical or digital void cheques aren’t an option, you can request a bank‑issued direct‑deposit form often called a pre‑authorized debit form. It lists the same MICR details and might even include a bank stamp for extra legitimacy. Just confirm that the receiving party accepts it in lieu of a cheque.

Frequently Asked Questions (FAQs)

Does a void cheque expire?

Not really. As long as your account and routing numbers stay the same, any void cheque you provide remains valid. But best practice: use one issued within the last two to three months.

Can someone misuse my void cheque?

It cannot be redeemed because it is marked VOID and has a slashed signature line. However, handle it as any other important document, sealing it in an envelope and uploading it via a secure site.

What if I lose my void cheque?

Contact your bank for peace of mind, watch your statements, and order a new chequebook if necessary.

What is a void cheque for direct deposit?

A void cheque for direct deposit is a standard cheque with the word “VOID” written on it. It shows your account and bank details so your employer or service provider can deposit money directly into your account safely.